Contents

– ValuePenguin – USDA Direct vs. Guaranteed Loan Requirements. The USDA direct loan is designed to support low income households who wouldn’t otherwise be able to secure any sort of home financing. This leads to more income restrictions on direct loans compared to guaranteed loans.

USDA loans are one of the few no money down loan options left.. single family Guaranteed Loans, Single Family Direct Loans and Single Family. To find out whether you meet location and income qualifications, look up.

Purpose: Section 502 loans are primarily used to help low-income. Eligibility: Applicants for direct loans from HCFP must have very.

A USDA direct loan is part of the Section 502 Direct Loan Program, and the two loan names are often used interchangeably. The program was created to help low-income buyers purchase safe, sanitary homes in rural areas with some assistance from the USDA.

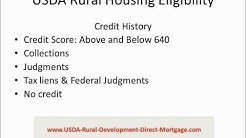

Eligibility for USDA Home Loans. The USDA home loan is available to borrowers who meet income and credit standards. Qualification is easier than for many other loan types, since the loan doesn’t require a down payment or a high credit score.

The program lets people with USDA direct or guaranteed home loans refinance in order to take advantage. 1 and include: Increased lender eligibility. Many small community banks and credit unions,

Single Family direct homeownership usda Loan. This type of USDA loan helps low-income.

Single Family direct homeownership usda Loan. This type of USDA loan helps low-income.

MIDDLEBURG – USDA’s Farm Service Agency. Applicants must meet the eligibility requirements for a given program before FSA can extend program benefits. For additional information or applications for.

USDA provides homeownership opportunities to rural Americans, and home renovation and repair programs. USDA also provides financing to elderly, disabled, or low-income rural residents in multi-unit housing complexes to ensure that they are able to make rent payments. Multi-Family Housing rentals; single family Housing Direct Home Loans

No Down Payment Homes What Day Is Usda Working On The United States Department of Agriculture (USDA), also known as the Agriculture Department, is the U.S. federal executive department responsible for developing and executing to farming, forestry, and food. It aims to meet the needs of farmers and ranchers, promote agricultural trade and production, work to assure food safety, protect natural resources, foster rural.Zero Down Payment AND Zero Closing Costs Home Loans! Buying a new home can be very costly, keep your money in your pocket and use it to purchase all.0 Down Mortgage Lenders Home Loan Organization If you are looking to start a non profit organization, you may be eligible for very inexpensive funding or grants.Not all charity organizations will qualify, however, as there are strict legal requirements to meet along the way. Whether you are starting new or looking to expand, consider the SBA a source of potential financing for your loan.The HomeNow program at MoFi allows approved lenders to provide down payment and closing cost assistance to eligible borrowers in the state of Montana .

Viewing eligibility maps on this website does not constitute a final determination by Rural Development. To proceed with viewing the eligibility map, you must accept this disclaimer. The ineligible areas shown on these maps do not apply to Farm Labor Housing financed under Section 514 and Section 516 of the Multi-Family Housing program.