Contents

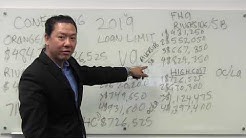

Conforming loan limits fannie mae and Freddie Mac are restricted by law to purchasing single-family mortgages with origination balances below a specific amount, known as the "conforming loan limit."

To find a complete list of FHA loan limits, areas at the FHA ceiling, areas between the floor and the ceiling, as well as a list of areas with loan limit increases, visit FHA’s Loan Limits Page. ### HUD’s mission is to create strong, sustainable, inclusive communities and quality affordable homes for all.

Fha Loan Application If you’re thinking about a Renovation Loan, it makes sense to partner. the process for case number assignments for applications utilizing the Single-Unit Approval process. And in September, FHA.

FHA Government Loans .org is a not a lender or a mortgage broker. We do not direct market by phone or email consumers. We do not provide any loans, loan modifications or foreclosure services. note- fha government Loans .org is not affiliated with HUD or FHA and is not a government agency.

Loan Limits. VA does not set a cap on how much you can borrow to finance your home. However, there are limits on the amount of liability VA can assume, which usually affects the amount of money an institution will lend you.

The loan limits by area are listed below via the hud website. simply input your local information to find out what the limit of the home loan is in your area. In order to qualify for an FHA loan, you cannot go over this amount.

An FHA Loan is a mortgage that’s insured by the Federal Housing Administration. They allow borrowers to finance homes with down payments as low as 3.5% and are especially popular with first-time homebuyers. FHA loans are a good option for first-time homebuyers who may not have saved enough for a large down payment.

An FHA Loan is a mortgage that’s insured by the Federal Housing Administration. They allow borrowers to finance homes with down payments as low as 3.5% and are especially popular with first-time homebuyers. FHA loans are a good option for first-time homebuyers who may not have saved enough for a large down payment.

Find a HUD-approved housing counselor in your area online or call 1-800-569- 4287 to find a.. PHAs use income limits developed by HUD.

Fha Minimum Requirements These loans generally have a shorter repayment term than loans on traditional homes and require the mobile home to meet specific requirements. The FHA distinguishes mobile. of each transportable.

FHA loan limits.–The Committee directs HUD to review FHA loan limits in large land area counties that experienced a reduction of at least 25 percent to FHA loan limits in 2014 when the Housing economic recovery act’s loan limits replaced those in the Economic Stimulus Act of 2008. The study should analyze if a county’s geographic size distorts

Apply For An Fha Home Loan Applying for an FHA loan. Home ownership is a goal that can be tough to reach. FHA loans can make it easier. With low down payments, relaxed credit requirements and competitive rates, FHA loans are designed to meet the needs of first-time homebuyers and other buyers whose credit or finances might make it difficult to qualify for a conventional mortgage.