Contents

balloon loan definition Definition: A loan that requires a single, usually final, payment that is much greater than the payment preceding it Though balloon loans are usually written under–and called by–another name.How Does A Balloon Payment Work Quite simply, a balloon payment is a lump sum payment that is attached to a loan. The payment, which has a higher value than your regular repayment charges, can be applied at regular intervals or, as is more usual, at the end of a loan period.

Calculator Rates commercial property loan calculator. This tool figures payments on a commercial property, offering payment amounts for P & I, Interest-Only and Balloon repayments – along with providing a monthly amortization schedule. This calculator automatically figures the balloon payment based on the entered loan amortization period.

You may be able to negotiate a better interest rate with a balloon mortgage. This will allow you to save additional funds over the mortgage term for the balloon payment at the end. For a mortgage balloon payment loan, you may be able to save money by refinancing or selling your home before the maturity date.

1 day ago. General mortgages, Balloon mortgages, mortgage prepayment, Renting and. Generates a table with variable loan amounts and interest rates.

1 day ago. General mortgages, Balloon mortgages, mortgage prepayment, Renting and. Generates a table with variable loan amounts and interest rates.

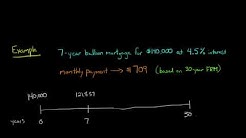

In other respects, a balloon mortgage resembles an adjustable rate mortgage (ARM) with an initial rate period equal to the balloon period. A 7-year balloon, for example, is usually compared to a 7-year ARM. Both have a fixed-rate for 7 years, after which the rate will be adjusted.

Press the Balloon Only button and you will see that you can pay off the mortgage with a balloon payment of $66,328.13. You are getting a $150,000 mortgage loan with a 3 year fixed interest rate of 4.5%.

15 Year Amortization With 5 Year Balloon A 30/15 balloon mortgage loan is a 15-year loan. The "30" represents the amortization period, which is calculated for 30 years, and the "15" stands for the length of the loan.

If, however, you financed the same car over 72 months with no deposit and a balloon payment or residual value of 30%, the monthly repayment at an interest rate of 12% would be R3 429.63. De Kock says.

A "piggyback" can be a first mortgage for 80% of the home’s value and a second mortgage for 5% to 20% of value, depending upon how much the borrower puts down as a payment. In some cases the second mortgage is an adjustable rate; however an increasingly common option is the 15 year balloon.

Calculate balloon mortgage payments. A balloon mortgage can be an excellent option for many homebuyers. A balloon mortgage is usually rather short, with a term of 5 years to 7 years, but the payment is based on a term of 30 years. They often have a lower interest rate, and it can be easier to qualify for than a traditional 30-year-fixed mortgage. There is, however, a risk to consider.

During the next crisis when short-term interest rates are already at zero – for the Fed, that is still the lower bound – the Fed might not do the type.