Contents

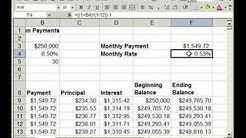

Check out the web's best free mortgage calculator to save money on your home loan today.. Down payment: $ %. Loan Amount: $. Interest Rate: %. Loan Term: years. By default we show purchase rates for fixed-rate mortgages.. busts this century it can make sense to purchase a smaller home with a 15-year mortgage.

Check out the web's best free mortgage calculator to save money on your home loan today.. Down payment: $ %. Loan Amount: $. Interest Rate: %. Loan Term: years. By default we show purchase rates for fixed-rate mortgages.. busts this century it can make sense to purchase a smaller home with a 15-year mortgage.

Advantages of a 15-Year Fixed-Rate Home Loan. The big advantage of a 30-year home loan over a 15-year loan is a lower monthly payment. However, for those who can afford the slightly higher payment associated with a 15-year mortgage are getting a better deal in almost every possible way.

Debating between the merits of a 15-year and a 30-year fixed-rate mortgage? This calculator does the work for you. It simultaneously runs calculations for a.

Key Tips & Advice. Things to consider when buying a home: While the 30-year mortgage is the most popular term in the United States, a 15-year term builds equity much quicker;

These are not marketing rates, or a weekly survey. The rate for a 15-year fixed home loan is currently 3.06 percent, while the rate for a 5-1 adjustable-rate mortgage (ARM) is 2.85 percent. Below are.

Pre Qualifying For A Home Loan Mortgage Loan Qualification . Before house-hunting ever begins, it is good to know just how much house the borrower can afford. By planning ahead, time will be saved in the long run and applying for loans that may be turned down and bidding on properties that cannot be obtained are avoided.

What is a 15-year fixed mortgage? A 15-year fixed mortgage is a mortgage that has a specific, fixed rate of interest that does not change for 15 years. If you choose a 15-year fixed mortgage, your monthly payment will be the same every month for 15 years.

Who Qualifies For Fha Loan What Credit Score Do I Need for a Home Loan? – . why you should aim for a higher credit score than your loan requires Just because you can qualify for a conventional mortgage with a 620 FICO® Score, or an FHA loan with a FICO® Score in the 500s,

A 30-year fixed-rate mortgage is the most common type of mortgage. However, some loans are issues for shorter terms, such as 10, 15, 20 or 25 years. Getting a .

Of those people who finance a purchase, nearly 90% of them opt for a 30-year fixed rate loan. The 15-year fixed-rate mortgage is the second.

15-year vs. 30-year mortgage. There are pros and cons to both 15- and 30-year mortgages. A 15-year mortgage will save you money in the long run because interest payments are drastically reduced.

15-year vs 30-year Mortgage. The 15-year and 30-year fixed-rate mortgages are the two most popular fixed-rate mortgages. While there are pros and cons to choosing each type of mortgage, it really comes down to your financial situation and long-term goals.

The average rate on 15-year, fixed-rate loans slipped to 4.23 percent this week. And the shortage of available homes has pushed prices higher. To calculate average mortgage rates, Freddie Mac.